If you’re planning for retirement, you’ll want to consider implementing safe and simple options strategies to generate income. Options with Davis provides a video where he shares three strategies for retirement income, focusing on safety and reliability. The strategies discussed include generating income with credit spreads, consistent income with the Iron Condor, and recurring profits with the Wheel Strategy.

These strategies are characterized by not requiring ownership of shares, short duration trades lasting 24 to 45 days, risk only to one side, and selecting underlying assets with positive drift. By choosing safe strategies for retirement income, you can minimize risk and ensure a consistent source of income during your retirement years. Make sure to watch the video for more information on option trading strategies specifically designed for retirement.

Safe & Simple Options Strategies for Retirement Income

When it comes to planning for retirement income, it’s crucial to consider strategies that prioritize safety and reliability. Option trading can offer a unique opportunity to generate consistent income during your retirement years. By implementing safe and simple options strategies, you can ensure financial stability and peace of mind as you enjoy your retirement.

Introduction to Safe Options Strategies for Retirement Planning

Navigating the complex world of options trading can be intimidating, especially for those looking to secure income for their retirement. However, with the right knowledge and strategies, you can leverage the power of options to create a reliable source of income. Safe options strategies are designed to minimize risk while maximizing returns, making them an ideal choice for retirement planning.

Information on Video by Options with Davis

Options with Davis is a valuable resource for individuals seeking to learn more about options trading and how to use it effectively for retirement income. Through informative videos, Options with Davis provides insights into various options strategies, including credit spreads, iron condors, and the wheel strategy. By watching these videos, you can gain a deeper understanding of how options trading works and how it can benefit your retirement portfolio.

Free Download of The Options Income Blueprint and The Credit Spreads Blueprint

To further enhance your options trading knowledge, Options with Davis offers free downloads of The Options Income Blueprint and The Credit Spreads Blueprint. These comprehensive guides provide detailed information on how to implement these strategies effectively, allowing you to generate income and protect your retirement savings.

Details About the Mentorship Program Offered

In addition to the valuable resources available for free download, Options with Davis also offers a mentorship program for individuals looking to deepen their understanding of options trading. By enrolling in this program, you can receive personalized guidance and support from experienced traders, helping you navigate the complexities of options trading with confidence.

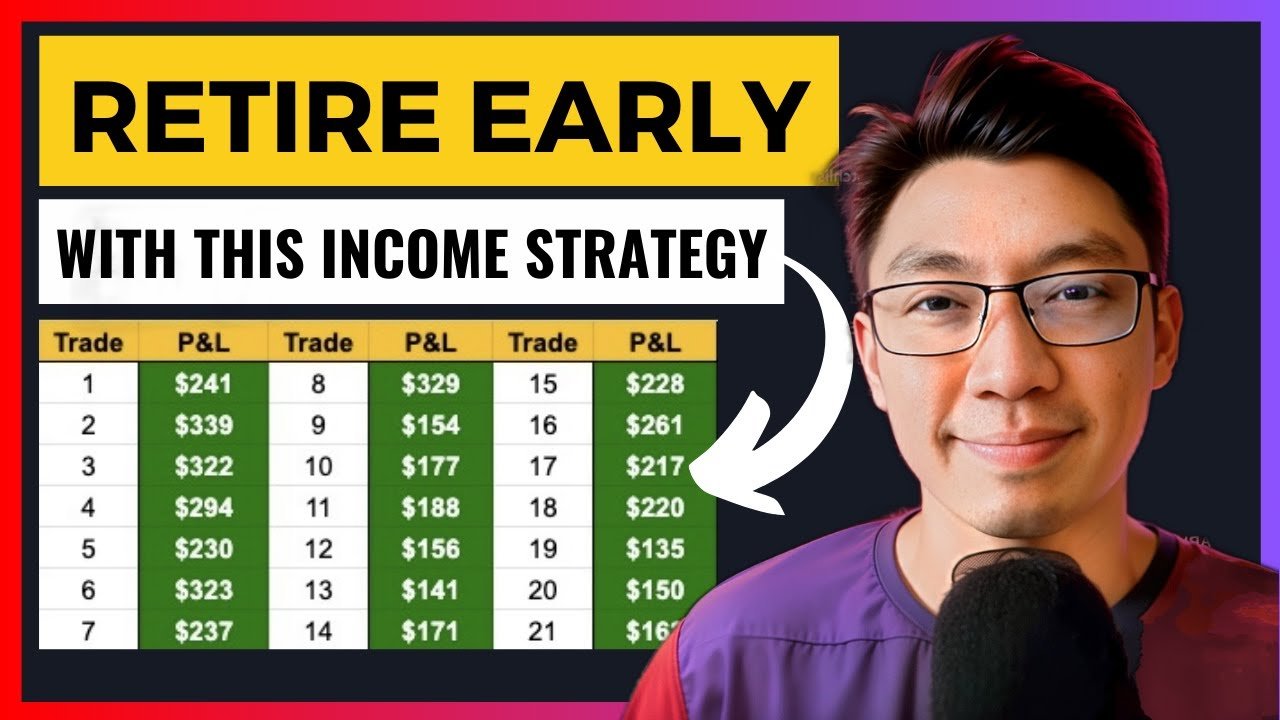

Case Studies Shared to Highlight Successful Strategies

To illustrate the effectiveness of safe options strategies for retirement income, Options with Davis presents case studies that showcase successful trades and outcomes. By examining real-life examples, you can gain insight into how these strategies can be implemented in different market conditions to generate consistent returns.

Options Strategies for Retirement Income

Information on 3 Options Strategies Shared in the Video

In the video by Options with Davis, three key options strategies are highlighted as ideal choices for retirement income. These strategies include generating income with credit spreads, achieving consistent income with the iron condor, and creating recurring profits with the wheel strategy. Each of these strategies offers unique benefits and can be tailored to individual risk tolerances and financial goals.

Explanation of How These Strategies Are Safe and Reliable

Safe options strategies prioritize risk management and capital preservation while generating consistent income. By utilizing strategies such as credit spreads, iron condors, and the wheel strategy, you can minimize potential losses and maximize profit potential. These strategies are designed to provide steady returns over time, making them reliable sources of retirement income.

Generating Income With Credit Spreads

Credit spreads involve selling an option with a higher premium and purchasing an option with a lower premium simultaneously. This strategy allows you to profit from the spread between the two options while limiting your downside risk. Credit spreads can be an effective way to generate income consistently and can be tailored to various market conditions.

Consistent Income With The Iron Condor

The iron condor strategy involves selling both a call spread and a put spread on the same underlying asset simultaneously. This strategy allows you to profit from range-bound markets and can provide steady income through premium collection. By managing your positions effectively, you can maintain a high probability of success with iron condors and generate consistent returns.

Recurring Profits With The Wheel Strategy

The wheel strategy, also known as the “income grid” wheel strategy, combines options selling and stock ownership to generate recurring profits. By selling cash-secured puts on stocks you are willing to own, you can generate income through premium collection. If assigned shares, you can then sell covered calls to further enhance your returns. The wheel strategy offers a methodical approach to generating income and can be a valuable addition to your retirement portfolio.

Characteristics of Safe Option Strategies for Retirement Income

Do Not Require Owning Shares

Safe options strategies for retirement income do not require owning shares of the underlying asset. Instead, these strategies involve buying and selling options contracts to generate income without the need for stock ownership. This minimizes risk and allows you to benefit from market movements without the associated costs and complexities of owning shares.

Short Duration Trades (24 to 45 Days)

To capitalize on market opportunities and minimize risk exposure, safe options strategies for retirement income typically involve short-duration trades lasting between 24 to 45 days. By focusing on shorter time frames, you can take advantage of time decay and volatility fluctuations to generate income consistently. Short-duration trades allow for more frequent adjustments and flexibility in managing your positions.

Select Strategies With Risk to One Side

Safe options strategies for retirement income prioritize risk management by selecting strategies with risk to one side. By structuring trades with limited downside risk and well-defined profit potential, you can minimize losses and enhance your overall risk/reward profile. Strategies that involve risk to one side simplify position management and allow for strategic adjustments as market conditions change.

Choose Underlying Assets With Positive Drift

When selecting underlying assets for safe options strategies, it’s essential to choose assets with positive drift. Positive drift refers to the tendency of certain stocks or ETFs to trend higher over time. By aligning your options strategies with assets that have a positive drift, you can increase the probability of successful trades and generate consistent income. Choosing assets with positive drift enhances the overall stability and performance of your retirement portfolio.

Focus on Safety and Retirement Income

Strategies Designed to Prioritize Safety and Consistent Income During Retirement

Safe options strategies for retirement income are specifically designed to prioritize safety and consistent income over speculative gains. By focusing on risk management, capital preservation, and reliable income generation, these strategies offer a stable and sustainable approach to investing for retirement. Whether you are a novice investor or an experienced trader, safe options strategies can provide the financial security and peace of mind you need to enjoy your retirement years.

How Option Trading Can Be a Reliable Source of Retirement Income

Option trading has the potential to be a reliable and profitable source of retirement income when implemented correctly. By leveraging safe options strategies, you can generate consistent returns, protect your capital, and minimize risk exposure. With careful planning, strategic decision-making, and ongoing education, option trading can provide a valuable income stream that complements other retirement savings and investments. By focusing on safety and reliability, option trading can help you achieve your financial goals and enjoy a comfortable retirement lifestyle.

Additional Resources

Videos Available for More Information on Option Trading Strategies

In addition to the resources provided by Options with Davis, there are numerous videos available that offer in-depth insights into various option trading strategies. These videos cover a wide range of topics, including advanced options strategies, risk management techniques, and market analysis. By watching these videos and expanding your knowledge of options trading, you can enhance your skills, make informed decisions, and optimize your retirement income strategy.

Opportunities to Learn and Improve Option Trading Skills

For those looking to learn more about option trading and improve their skills, there are ample opportunities to further your education and expertise. By enrolling in online courses, attending webinars, and participating in trading communities, you can gain valuable insights, practical experience, and mentorship from seasoned professionals. By dedicating time and effort to learning and improving your option trading skills, you can build a strong foundation for success and enhance your ability to generate reliable retirement income.