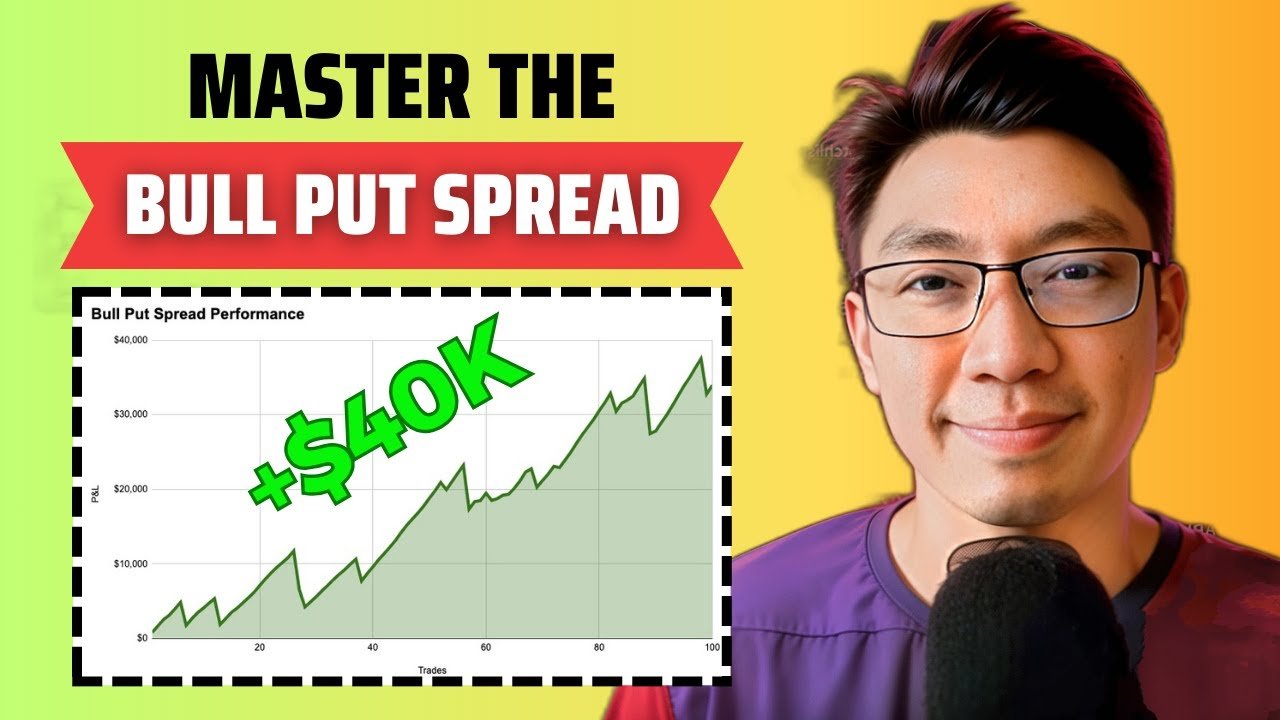

So let’s talk about this Bull Put Spread Strategy that Options with Davis has been raving about. This strategy aims to finally make you profitable in trading options. By downloading the free PDF of The Options Income Blueprint and watching the instructional video, you will learn how to implement this strategy successfully. With an 82% win rate and a focus on choosing the right days to expiration (DTE), this strategy could be the game-changer you’ve been looking for in your trading journey.

Now, before you dive into this strategy, let’s address some common struggles that traders face when dealing with the Bull Put Spread. From small winners compared to larger losers to the challenge of one loss wiping out multiple gains, these are issues that can hinder your success. By understanding the theoretical win rate versus the actual win rate and implementing the tips provided in the video, you can navigate these challenges and trade the Bull Put Spread profitably. So get ready to take your trading to the next level with the knowledge and insights shared in this strategy.

Understanding the Bull Put Spread Strategy

If you’re looking to delve into options trading strategies, the Bull Put Spread Strategy is a popular choice among traders. This strategy involves selling a put option while also purchasing a put option with a lower strike price as a hedge. The goal is to profit from a bullish market where the underlying asset’s price is expected to rise or remain stable. Understanding how to implement and manage this strategy effectively can lead to consistent profits over time.

Overview of the Bull Put Spread Strategy

The Bull Put Spread Strategy is a defined-risk strategy that allows traders to benefit from a bullish market outlook. By selling a put option and buying another put option with a lower strike price, traders can limit their potential losses while still generating income from the premiums received. This strategy is ideal for traders who are moderately bullish on a particular stock or index and want to capitalize on potential price increases.

Common struggles in trading the Bull Put Spread

While the Bull Put Spread Strategy can be a lucrative trading strategy, many traders face common struggles when implementing it. One of the main challenges is the perception that the winners are too small compared to the losers. This discrepancy can lead to frustration and hinder overall profitability. Additionally, some traders find that one significant loss can wipe out multiple smaller gains, impacting their overall trading performance. Understanding how to address these challenges is key to successful trading with the Bull Put Spread Strategy.

Statistics of the Bull Put Spread Strategy

Analyzing the performance statistics of the Bull Put Spread Strategy can provide valuable insights into its effectiveness. Traders often look at key metrics such as win rate, average profit, average loss, and overall expectancy to gauge the strategy’s success. By examining historical trade data and performance metrics, traders can refine their approach and optimize their trading strategy for better results.

Choosing the right DTE for the Bull Put Spread

Selecting the appropriate Days to Expiration (DTE) is crucial when trading the Bull Put Spread Strategy. The DTE refers to the number of days until the options contract expires, and choosing the right timeframe can impact the strategy’s performance. Traders need to consider factors such as market volatility, risk tolerance, and profit objectives when determining the optimal DTE for their trades. By selecting the right DTE, traders can enhance their chances of success and minimize potential risks.

Implementing the Bull Put Spread Strategy

To effectively implement the Bull Put Spread Strategy, traders can adopt specific tactics and techniques to maximize their profits and minimize risks. Utilizing research and findings from the Tastytrade team study, traders can gain valuable insights into market trends and timing strategies for optimal trade entry points. Additionally, incorporating tools like the stochastic oscillator can help traders identify potential market reversals and make informed trading decisions.

Using the Tastytrade team study findings

The Tastytrade team study provides valuable data and insights into market trends and trading strategies. By leveraging this research, traders can enhance their understanding of market dynamics and improve their trading performance. Analyzing the findings from the Tastytrade team study can help traders refine their approach to the Bull Put Spread Strategy and capitalize on profitable trading opportunities.

Utilizing the stochastic oscillator for market timing

The stochastic oscillator is a technical indicator that traders can use to identify potential market trends and reversals. By analyzing the oscillator’s signals, traders can determine optimal entry and exit points for their trades. Incorporating the stochastic oscillator into their trading strategy can help traders make more informed decisions and improve their overall trading performance.

Identifying support levels before entering a trade

Before entering a Bull Put Spread trade, it’s essential to identify key support levels for the underlying asset. Support levels indicate price levels where the asset is likely to find buying interest and potentially reverse its downtrend. By analyzing support levels, traders can better assess the risk-reward ratio of their trades and make more strategic decisions when implementing the Bull Put Spread Strategy.

Selecting the appropriate DTE for trade entry

Choosing the right Days to Expiration (DTE) is crucial for successful trade entry with the Bull Put Spread Strategy. Traders need to consider factors such as market volatility, upcoming events, and their profit targets when determining the optimal DTE for their trades. Selecting the appropriate DTE can help traders maximize their profits and minimize potential risks when trading the Bull Put Spread Strategy.

Choosing the short put strike with the optimal delta range

When selecting the short put strike for the Bull Put Spread, traders should focus on choosing a strike with an optimal delta range. Deltas between 20 and 30 are commonly recommended for this strategy, as they balance the trade-off between win rate and premium received. By selecting a short put strike within the optimal delta range, traders can improve their chances of profitability and reduce potential losses.

Constructing the long put side based on risk per trade

Constructing the long put side of the Bull Put Spread should be based on the trader’s risk tolerance and overall trading objectives. Traders can determine the appropriate risk per trade by calculating their maximum allowable loss and adjusting the position size accordingly. By structuring the long put side based on risk per trade, traders can control their potential losses and manage their overall risk effectively.

Managing Risks and Rewards

Effective risk management is essential when trading the Bull Put Spread Strategy to ensure long-term profitability and minimize potential losses. By understanding the risks and rewards associated with different spread widths and analyzing the risk profile with an options trading platform, traders can make informed decisions and optimize their trading strategy for better results.

Understanding different widths of bull put spreads

Bull Put Spreads come in various widths, depending on the difference between the strike prices of the short and long puts. Narrower spreads offer lower potential profits but also lower risks, while wider spreads provide higher profit potential but carry higher risks. By understanding the implications of different spread widths, traders can tailor their strategy to match their risk tolerance and profit objectives effectively.

Exploring risk levels at various spread widths

Analyzing risk levels at different spread widths can help traders assess the potential risks and rewards of their trades. Narrower spreads typically have lower risk but offer limited profit potential, while wider spreads come with higher risks but also higher rewards. By exploring risk levels at various spread widths, traders can strike a balance between risk and reward and make informed trading decisions.

Analyzing risk profile with an options trading platform

Utilizing an options trading platform can provide valuable insights into the risk profile of Bull Put Spread trades. By analyzing the risk-reward ratios, maximum loss potential, and breakeven points of their trades, traders can gauge the overall risk exposure of their positions. Understanding the risk profile with an options trading platform can help traders adjust their strategies and optimize their trades for better outcomes.

Importance of monitoring profit and loss at different expiration dates

Monitoring profit and loss at different expiration dates is vital for assessing the performance of Bull Put Spread trades. By tracking the profitability of their trades throughout the options contract’s lifespan, traders can identify trends, evaluate their strategies, and make necessary adjustments. Understanding the impact of different expiration dates on profit and loss can help traders improve their trading decisions and maximize their overall profitability.

Implementing an exit strategy at 21 DTE

Implementing an exit strategy at 21 Days to Expiration (DTE) is a common practice among Bull Put Spread traders to manage their positions effectively. By closing out or rolling over their trades at 21 DTE, traders can avoid potential margin calls and minimize losses. Implementing an exit strategy at 21 DTE can help traders protect their profits, control their risks, and optimize their trading performance.

Consideration of taking 50% profit at 21 DTE

Traders may also consider taking 50% profit at 21 DTE as an alternative exit strategy for Bull Put Spread trades. By capturing half of the maximum profit early in the trade, traders can secure their gains and reduce their exposure to market fluctuations. Considering taking 50% profit at 21 DTE can help traders lock in profits, reduce risk, and enhance their overall trading success.

Tips for Successful Trading

To enhance your success with the Bull Put Spread Strategy, consider implementing the following tips and strategies to improve your trading performance and achieve positive results consistently.

Key tips for successful trading of bull put spreads

- Maintain a disciplined approach to risk management and position sizing to protect your capital and minimize potential losses.

- Conduct thorough research and analysis before entering any trade to identify optimal entry and exit points based on market conditions.

- Stay informed about market trends, news events, and economic indicators that can impact the performance of your trades.

- Review and analyze your trade performance regularly to identify strengths and weaknesses in your trading strategy and make necessary adjustments.

- Continuously educate yourself on options trading strategies, technical analysis, and risk management techniques to enhance your trading skills and knowledge.

Strategies for achieving positive results

Implementing a systematic approach to trade selection and risk management is essential for achieving positive results with the Bull Put Spread Strategy. By following a well-defined trading plan, setting clear profit targets, and managing your risks effectively, you can increase your chances of success and achieve consistent profitability over time.

Caution around deltas below 20 and above 30

When selecting strike prices for the Bull Put Spread, be cautious of deltas below 20 and above 30, as they can impact the trade-off between win rate and premium received. Deltas within the optimal range of 20-30 offer a balanced strategy that maximizes profitability while managing risk effectively. By avoiding extreme deltas, traders can ensure a more balanced approach to trading and enhance their overall success with the strategy.

Balancing win rate and premium in trade selection

Achieving a balance between win rate and premium in trade selection is essential for optimizing your profitability with the Bull Put Spread Strategy. While higher win rates are desirable, they must be balanced with the premium received from each trade to maximize overall profits. By focusing on strike prices with optimal deltas and adjusting position sizes accordingly, traders can strike a balance between win rate and premium and achieve long-term success with the strategy.

In conclusion, the Bull Put Spread Strategy offers traders a structured approach to generate income and profit from bullish market conditions. By understanding the strategy’s key components, implementing effective trade management techniques, and adhering to disciplined risk management practices, traders can enhance their trading performance, minimize potential losses, and achieve consistent profitability over time. By incorporating these tips and strategies into your trading approach, you can optimize your success with the Bull Put Spread Strategy and increase your chances of achieving positive results in the options market.